Regen director Johnny Gowdy reflects on the recent decision by Vattenfall to pause its Norfolk Boreas project and what this means for offshore wind in the UK.

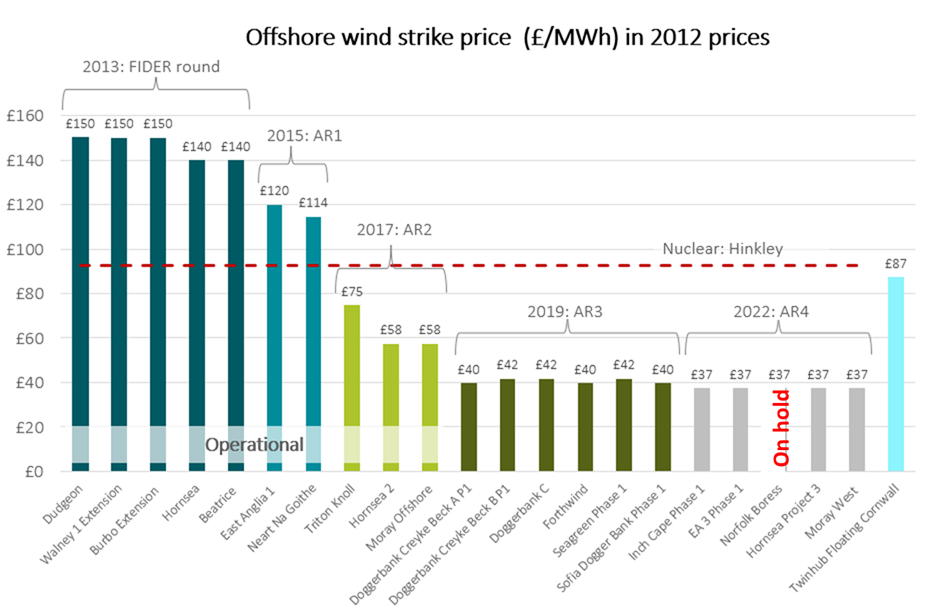

The decision by Vattenfall to park its Norfolk Boreas project marks a turning point for UK offshore wind. After a decade of rapid cost reduction and inexorable industry growth, the flag has been raised that, based on very low strike prices, some projects are no longer viable.

It was anticipated, and probably priced into industry thinking, that the cost shock experienced in 2022/23 would have an impact on the offshore wind sector. The alarm had already been raised by major turbine manufacturers who have been sustaining losses while trying to deliver more capacity in a high growth sector.

Several factors have brought the industry to this point: a jump in commodity, component and construction cost, rising interest rates and international competition for capital, Contract for Difference (CfD) auction timings and the intense level of competition and, one must say, a degree of over-optimism amongst bidders and their supply chain.

Figure 1: Offshore wind CfD strike prices (2012 prices)

| It should be noted however that, as of writing, two other big Allocation Round 4 (AR4) projects, Hornsea 3 and East Anglia 3, seem to be progressing and are moving forward with major contract awards. The respective developers, Orsted and Scottish Power, have highlighted the challenging environment and have called for government investment support (e.g. via changes to tax allowances) but, so far, have not announced a significant delay. What this probably says is that timing as well as the source of finance is critical; those projects that managed to secure finance before the latest interest rate spike, and flow of capital to the US and other overseas markets, will be in a better position.

The shelving of some AR4 projects could be seen as a simple miscalculation; even with an inflationary adjustment, bidders got the price wrong and there is no easy way within the CfD framework to renegotiate struck prices. The results of the current CfD AR5 auction could potentially have greater consequences, if, as expected, the level of bidding is less than budgeted, with key projects in both fixed and floating technologies holding back new capacity. With any further delays to AR4 projects, a drop in AR5 capacity would mean a real danger that a pipeline gap will open up in the period 2026-2029, and the UK will miss it build-out targets. We will find out in early September. Costs can be recalculated, projects can be shifted but a significant gap in the buildout of projects would severely impact the supply chain and infrastructure providers on which the industry relies, and threatens to undo the cost and efficiency gains won over the last decade. This would then have an impact on jobs and skills, and investor confidence, in an industry that has been a great UK success story. This scenario, which we described in a previous blog as the government’s ‘big gamble’ really would be consequential for the future of offshore wind in the UK and cannot be allowed to happen. What happens next is critical. Norfolk Boreas is not the end for offshore wind – far from it. Offshore wind is still an attractive investment opportunity and will still be good value for the consumer even with a cost increase, remembering that costs have jumped across all energy technologies. But we do need a reset, an adjustment to the new reality of higher construction costs and a higher cost of capital. In the longer term, we might imagine some significant changes to the CfD scheme to address the issue of cost risk, for example with new contingency measures. But there is no time to wait for market reforms, in the near term we will have to work within the CfD framework. Assuming that AR5 is now a done deal, government and industry attention must shift to AR6 and AR7 to repair the damage. Unlike previous rounds which have focused on cost minimisation through highly competitive bidding, AR6 needs to be aimed at filling in the pipeline gaps and re-establishing a high rate of construction to maintain the momentum towards 2030. This does not mean paying any price – officials at DESNZ and Treasury will still want to see value for money – but it does mean opening an honest dialogue with industry to come to an evidenced consensus about what the new cost base for offshore wind is. There is, however, some degree of trust to be built before this can happen. Interested in hearing more about Regen’s work in the offshore wind sector? Get in contact with Grace Millman, our offshore lead here. |