Today’s announcement that there have been no bids for new offshore wind farms in the government’s Contracts for Difference (CfD) Allocation Round 5 (AR5) is a disappointment, but not a surprise. The government now needs to take action to rebuild industry confidence and reestablish the pipeline of offshore wind projects.

Regen’s recommendations to government

-

Make an immediate announcement that it intends to significantly increase support for offshore wind, and that it is still the UK’s ambition to lead in both fixed-bottom and floating wind developments, with target capacities and dates for deployment between now and 2035.

-

Convene a task force with industry and their supply chain partners to interrogate what is happening with industry costs.

-

Reset the Administrative Strike Prices (ASPs) and budgets for offshore wind based on the evidence of the task force cost review and assessment of the cost of capital.

-

Review and amend the CfD pot structure to either reposition offshore wind in a separate pot to onshore wind and solar, or to establish budget minima for each technology within Pot 1.

-

Bring forward REMA reforms to the CfD scheme to provide a better solution for negative price periods, including a possible switch to deemed CfD payments.

-

Adopt a new approach for floating offshore wind through a strategic review of current demonstration projects, resulting in a bespoke CfD arrangement.

-

Accelerate grid investment and substantially reduce planning timescales for onshore and offshore wind.

At 14 GW of installed capacity, the UK currently has the largest offshore wind fleet outside of China. It has also been leading the development of floating wind technologies, with the second-largest floating offshore wind farm anchored off the coast of Aberdeen and several demonstration projects in the pipeline.

In truth, however, the UK’s leadership position as the biggest market for offshore wind was already in jeopardy due to a slowdown in construction projects and increased competition from the US, Asia and other European development areas. Nevertheless, offshore wind must still be considered a major UK success story, with a rapid fall in costs over the past decade and an associated increase in UK content and supply chain jobs. While other industries have struggled, offshore wind’s strategic importance has been reconfirmed by successive governments and energy ministers. Not only is offshore wind critical for net zero and the UK’s future energy security (in 2022, offshore wind generated 14% of the UK’s total electricity generation[1]), but its lower generation costs is a key driver in reducing future consumer bills. And that’s not to mention the 32,000 jobs currently supported by the industry.

Given its importance, today’s announcement that the latest CfD allocation round will support no new offshore wind projects is a blow to the industry and a significant setback for the government’s energy strategy.

It is clear how we got here. The previous Allocation Round 4 (AR4) was lauded as the most successful to date, with 7 GW of offshore wind contracts awarded at exceptionally low prices. But the warning signs were already beginning to appear, even before the energy price hike and the big jump in both input costs and cost of capital that have rocked the offshore sector.

In fairness, the industry was very open and forthright with government that past auctions may not be a good guide to future strike prices and that both the CfD budgets (pot sizes) and administrative strike price[2] (ASP) limits should be revised upwards to account for rising commodity costs and challenging economic factors. If further evidence was needed, reality hit in July this year with the decision by Vattenfall to pause its 1.4 GW Norfolk Boreas project, stating that it was no longer viable at the agreed AR4 price.

Misdirected or just a miscalculation?

Several factors have resulted in higher overall project costs[3]: a jump in commodity, component and construction costs, rising interest rates and international competition for capital. The CfD scheme does have a built-in inflationary adjustment[4], but this was insufficient to account for the steep rise in project input costs and had no provision to mitigate the increase in the cost of capital.

We don’t know the exact cost gap, but it is thought that the strike prices for fixed and floating offshore wind were likely around 10-25% (equivalent to around £5-12 per MWh) below a viable strike price for investment. It is worth noting that at these levels, the price of offshore wind would still be well below current wholesale prices and exceptionally good value for the UK consumer. Even if the strike prices had been higher, there would still have been questions around the overall AR5 CfD budget, which was £80 million below AR4 and included onshore wind and solar within the same competitive auction pot.

The government did allocate more capacity to both pots in August 2023; however, the extra £22 million (£20 million for Pot 1 and £2 million for Pot 2) did little to rescue to auction.

Assuming that government officials and ministers did at least hear the warnings from industry, it must be concluded that either they simply didn’t believe that cost increases were as bad as the industry claimed, or they were prepared to see the AR5 auction fail rather than go through a delay and revision process. Timing may also have been a factor; with the move to annual CfDs, they might have also felt they could manage any fall in CfD uptake in AR5 through future auction rounds rather than make immediate changes.

The position for floating wind was even more stark. Government officials were told point-blank by industry and supportive backbench MPs that the strike price would not be sufficient to bring projects forward. Given the importance of floating wind as an energy resource and a major export market, this is an obvious own-goal.

A gap in the pipeline

A free-market pragmatist might argue that the outcome of the AR5 auction is just a result of a highly competitive auction and the government’s unwillingness to countenance industry demanding greater revenue support. It should also be noted that offshore wind’s trouble has created an opportunity for onshore wind and solar, which have done very well and secured contracts for 1.5 GW and 1.9 GW of new projects, respectively.

The problem, however, is that the absence of new offshore wind capacity, coming on top of previous delays and project withdrawals, now threatens to create a significant gap[5] in the pipeline for new offshore projects. A significant gap in the buildout of projects, which we highlighted in our previous paper as the government’s ‘big gamble’, would severely impact the supply chain and infrastructure providers on which the industry relies, and threatens to undo the cost and efficiency gains won over the last decade. This would have severe consequences for the industry supply chain – potentially leading to job losses, a loss of capability and a shift in resources away from the UK market.

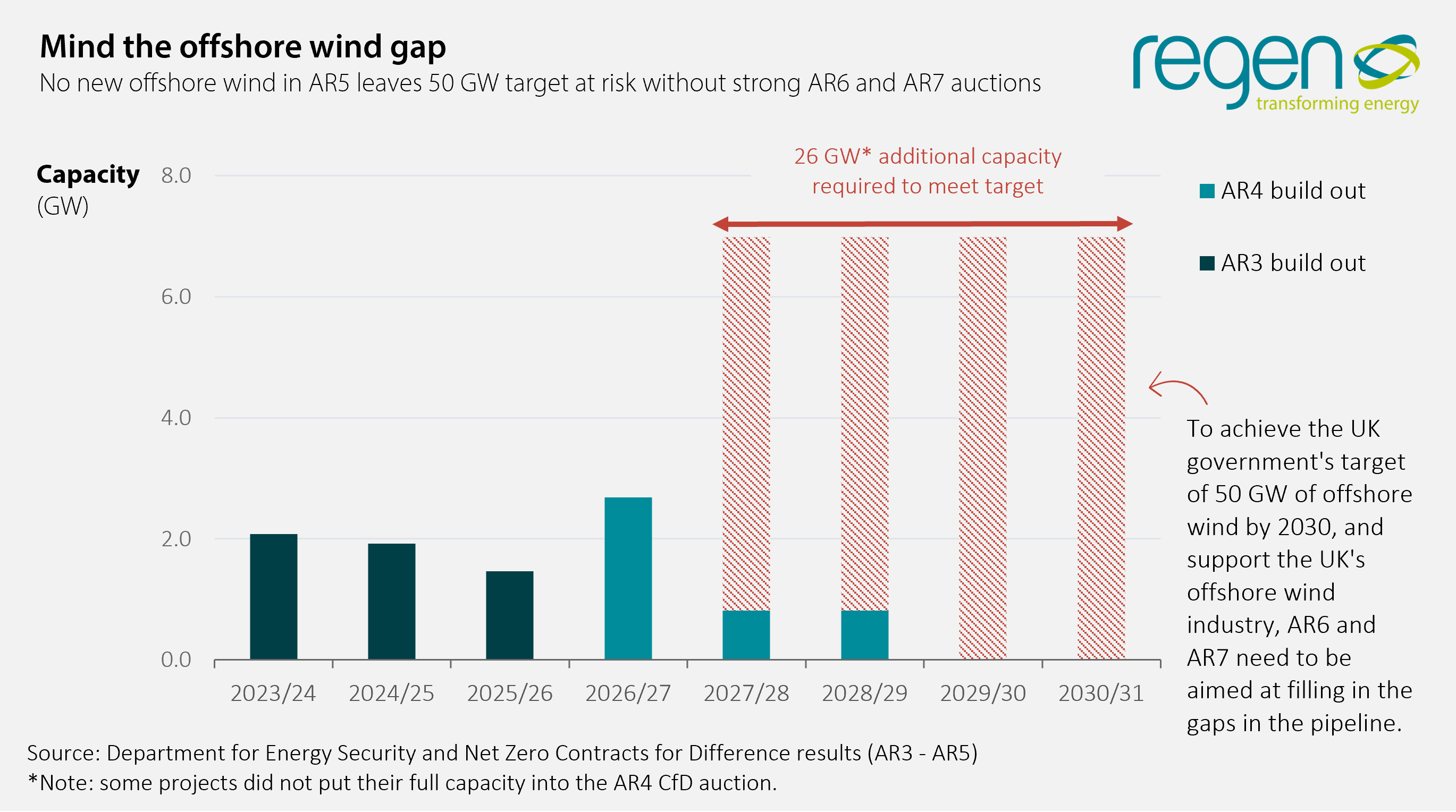

Our analysis in Figure 1 suggests that rather than the dramatic increase in offshore wind deployment that is needed, the UK pipeline now looks to be relatively flat over the period to 2026/27, with a major shortfall in new projects from 2027/28 onwards. The implication is obvious: if the UK is to get anywhere near the 50 GW target set by the Johnson Government, future allocation rounds would have to deliver a further 26 GW of offshore wind, substantially more than any historic rounds. Already, this may be unrealistic. The government must immediately take stock to ensure AR6 and AR7 (which will include delivery years 2027-2030) have large enough budgets to fill in the gaps in the pipeline, protecting the UK supply chain and rebuilding investor confidence.

Figure 1 – Gap in the pipeline of offshore wind projects

Immediate response from government needed

This really is a watershed moment for the current government and a test of whether it has the drive and commitment to deliver on the cornerstone of its net zero energy strategy.

There is a limited amount that the government or industry can do now about the low strike prices in AR4 and the lack of offshore wind capacity in AR5. It is not possible to re-run the auction, and any attempt to adjust prices post-auction would almost certainly run into legal challenges. Nor is there time to introduce a radically different revenue support mechanism, although this could be something for future consideration.

All focus now must be on redesigning and resetting the arrangements for the coming CfD allocation rounds, AR6 and AR7. This requires government and industry to move forward with a fresh approach, building an open and honest relationship based on a firm understanding of the industry’s cost model and financials.

Regen has a number of recommendations we would suggest that the government acts on now:

- Make an immediate announcement that it intends to significantly increase support for offshore wind, and that it is still the UK’s ambition to lead in both fixed-bottom and floating wind developments, with target capacities and dates for deployment between now and 2035.

- Convene a task force with industry and their supply chain partners to interrogate what is happening with industry costs. Price competition within the CfD auctions needs to be balanced with a realistic appraisal of what the true industry costs are, with strike budgets and budgets set accordingly.

- Reset the Administrative Strike Prices and budgets for offshore wind based on the evidence of the task force cost review and assessment of the cost of capital.

- Review and amend the CfD pot structure to either reposition offshore wind in a separate pot to onshore wind and solar, or to establish budget minima for each technology within Pot 1. In an ideal world, there would be free price competition between technologies. However, this does not sit well with a imperative to build strategic industries and establish UK-based supply chains.

- Bring forward REMA reforms to the CfD scheme to provide a better solution for negative price periods, including a possible switch to deemed CfD payments. The current negative price rule, under which CfD payments cease, introduces too much investment risk and market distortion.

- Adopt a new approach for floating offshore wind through a strategic review of current demonstration projects, resulting in a bespoke CfD arrangement. This should feature a ringfenced minima for floating offshore wind with an achievable administrative strike price, plus provision of lower cost finance.

- Accelerate grid investment and substantially reduce planning timescales for onshore and offshore wind.

[1] The Crown Estate’s 2022 Offshore Wind Report: https://www.thecrownestate.co.uk/en-gb/what-we-do/on-the-seabed/energy/offshore-wind-report-2022/

[2] ASP – a price cap for bids into the CfD auction, in effect a price ceiling which, industry has argued, has been set too low for auctions to even begin to offer a viable return.

[3] The design of the CfD means there is a time delay between projects getting a CfD and beginning construction, during which period costs can change. There is some mitigation within the CfD scheme as strike prices are inflation-adjusted, but this does not reflect the jump in costs of 20%-40% that has been reported. In addition, the Final Investment Decision for a project comes after winning a CfD award; with interest rates soaring and global competition for investment, the overall cost of capital has increased significantly. The CfD scheme does not currently have any adjustment for changes in the cost of capital.

[4] Set at the rate of the Consumer Price Index (CPI).

[5] For example, a 2-3 year period of low or reduced construction activity.