Hy to Hydrogen – why this abundant element could be crucial in achieving net zero

In the UK government’s Ten Point Plan, which focuses on “building back better, supporting green jobs, and accelerating our path to net zero”[i], the Prime Minister has committed to deploying 5 GW of low carbon hydrogen production capacity by 2030, as well as developing a pilot town powered entirely by hydrogen. Point two of the plan outlines the support that will be available for hydrogen production, including a £240 million Net Zero Hydrogen Fund. As interim milestones the government intends to publish a Hydrogen Strategy in 2021 and by 2025, to have reached 1 GW of hydrogen production capacity. This is the first time that hydrogen has held such a prominent place within government policy, but why is hydrogen considered so important to reach net zero?

Most strategies for decarbonisation are based around high levels of electrification of energy demand however it is widely accepted that not all parts of the UK’s energy use can be easily electrified. This is especially true in the areas which are heavily reliant on fossil fuels to provide high grade thermal energy such as industrial processes and heavy transport. Hydrogen can therefore be a useful complement to electrification in achieving net zero emissions. Given its importance and value, it is crucial to understand how hydrogen fuel can be best used and prioritised to achieve net zero at least cost. Hydrogen can also be used for inter-seasonal energy balancing, which will counteract generation fluxes from renewable energy. This is currently being explored in the H100 project in Fife which aims to be the first ‘100% hydrogen to homes zero carbon network’ in the world[ii].

Different types of hydrogen production

There are two main methods of producing hydrogen: electrolysis and methane reformation, of which there are several types including autothermal reformation (ATR) and steam methane reformation (SMR). The different methods of producing hydrogen are classified using a colour system.

- Typically using SMR, the current production of Grey hydrogen produces carbon dioxide, hence is not carbon neutral.

- Blue hydrogen is also derived from fossil fuels but when coupled with carbon capture and storage (CCS) could become a low carbon alternative. Current CCS technology achieves “lifecycle emissions savings of 60-85% relative to natural gas use in boilers”[iii]. The Committee on Climate Change (CCC) found that blue hydrogen is not a fully clean source of hydrogen unless CCS achieves 95% capture efficiency rates[iv].

- Green hydrogen is produced via electrolysis and is considered low carbon, as long as the input energy is renewable, or nuclear. Electrolysis is the process of using electricity to split water into hydrogen and oxygen and is the favoured production method for transport due to its product purity[v].

Production of hydrogen through electrolysis from curtailed renewable energy is a cost-effective way to produce hydrogen; however there are not many renewable sites that regularly have curtailed energy. Alternatively, off peak renewable electricity, available when supply exceeds demand, can be used for storage, interconnectors and hydrogen production. At the moment, green hydrogen costs between three and six times more than grey or blue hydrogen[vi]. A recent study by Wood Mackenzie believes that the cost of renewables-based hydrogen will fall by up to 64% by 2040[vii], with the price of blue hydrogen rising by 59% over the same period. This will only be possible if the price of clean electricity continues to fall, and the green hydrogen market grows, allowing the sector to employ economies at scale and to drive innovation.

Current capacity and the project pipeline

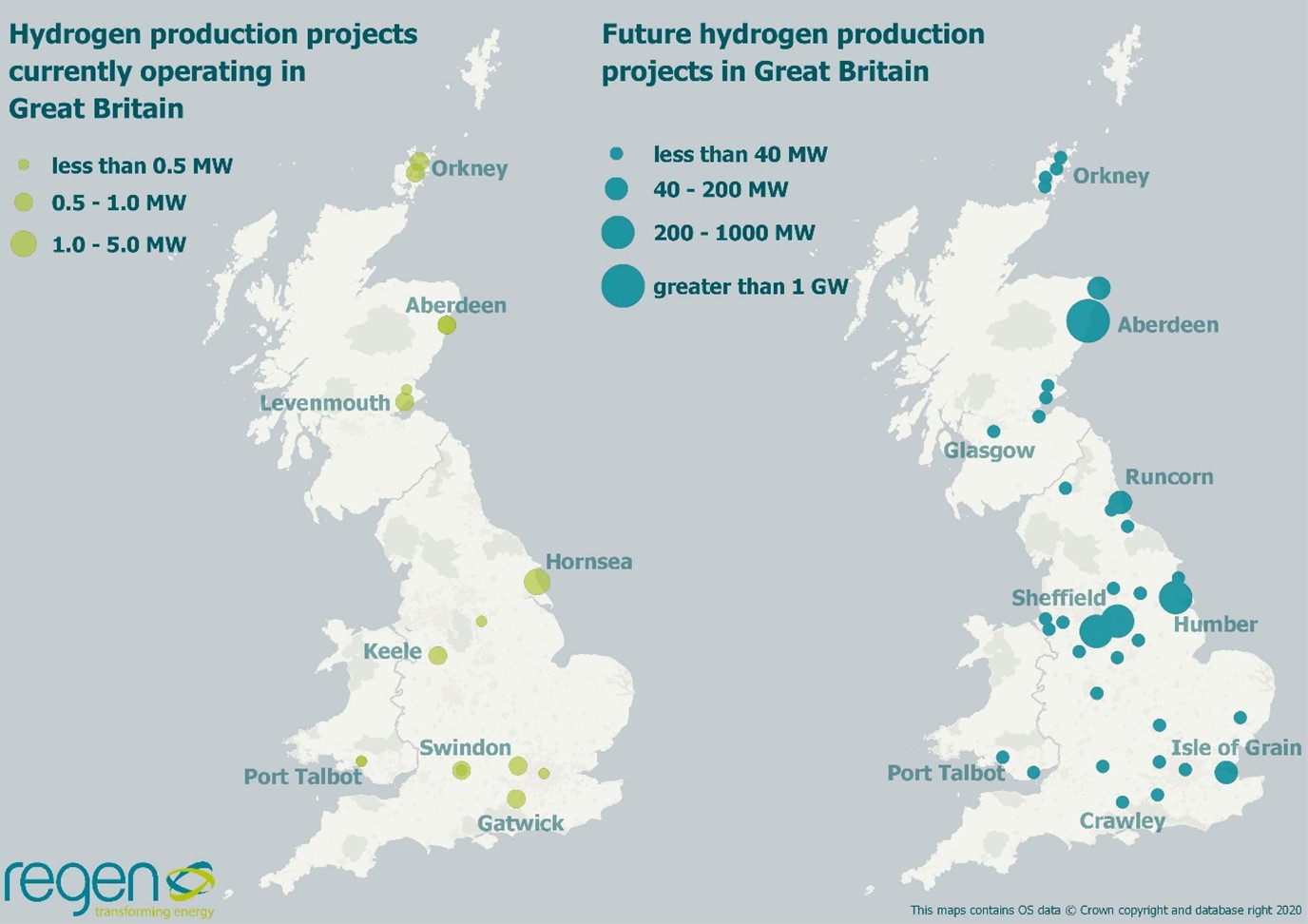

Reaching 5 GW of clean hydrogen production capacity by 2030 is an ambitious target. The UK currently produces around 27 TWh of grey hydrogen each year, according to the CCC[viii], which dwarfs the current production of green and blue hydrogen. Regen analysis, shown in Figure 1, has found that there is currently c.10 MW of low carbon hydrogen production from both green and blue hydrogen in Great Britain. This capacity consists of small scale trial projects, such as the BIG HIT project[ix] in Orkney, an extension of the ‘Surf n Turf’ electrolyser on the Isle of Eday[x], which uses curtailed wind and tidal energy to produce hydrogen which is then stored and transported to Kirkwall, where it is used for electricity and heat.

Image 1 – A representation of the hydrogen production chain in the BIG HIT[1] project in Orkney, which uses curtailed wind and tidal energy to produce green hydrogen used for storage, transport and heating.

There is however a significant pipeline of new projects, totalling 1.3 GW in the construction and late development phase. 1 GW of this pipeline is accounted for by ITM Power, who announced the lease of the world’s largest electrolyser in 2019[xi]. Bessemer Park in Sheffield is under construction and is to be completed by the end of 2020. It will originally have a capacity of 300 MW, but this is expected to increase to 1 GW by 2024[xii]. If this project is successful, this will single-handedly meet the government’s 1 GW by 2025 target.

Looking further to the future, Regen has identified a significant number of projects in research, feasibility study and early-stage development. This adds up to a speculative pipeline of c.18.7 GW of low carbon hydrogen capacity in Great Britain. Notably, 12 GW of this is proposed by the H21 project[xiii], which has a conceptual design for converting the gas networks of the North of England to blue hydrogen between 2028 and 2035. The Dolphyn project, which received £3 million in UK government funding earlier this year centres on a radical electrolyser design. The project is led by Environmental Resources Management (ERM) and involves integrating electrolysers into wind turbine platforms off the coast of Aberdeen. Although this is only in the research stage, they aim to have 4 GW capacity by 2037.

Figure 1 – Regen analysis of existing and pipeline hydrogen production projects in Great Britain

Future of the hydrogen market

In order to achieve 5 GW of low carbon hydrogen by 2030, significant investment will be needed not only in existing projects, but to encourage innovation of new projects. Future hydrogen production is likely to be co-located with consumers in areas of heavy industry and chemical processes, especially those allied with high energy availability, to form natural hydrogen clusters. The large baseload demand from industry could act as an “anchor for early projects”[xiv] which will then create a market for hydrogen demand. The second key market for hydrogen in transport could be more decentralised but is likely to see production clustered around major transport hubs such as ports.

Creating the value chain between hydrogen supply and demand will be crucial to drive innovation within the sector and in meeting the government’s hydrogen targets. Key locations include Scotland, due to its abundance of renewable energy and the ambition of Scottish government, the Humber region which is one of the UK’s largest industrial clusters, and South Wales which has a large industrial sector and gas imports.

Hydrogen is not a silver bullet in the path to net zero and is not the solution to short term emission reductions, however it can be a useful tool in decarbonising hard-to-electrify sectors. The introduction of hydrogen presents an opportunity to build on current capabilities and infrastructure within the UK. The UK has the resources and skills to build a world leading hydrogen economy, and the Ten Point Plan is a positive step towards achieving this. There needs to be a whole value chain approach to hydrogen, which is underpinned by the development of consumer markets, as well as investment in production, storage, and distribution infrastructure, which will require support and planning. On a small scale, i.e. within an industrial cluster, the route to market can be explored and decarbonisation in local areas can be encouraged. In order for low carbon hydrogen to reach its full potential, there needs to be a long term strategy founded on the development of hydrogen markets that will enable the production and supply of hydrogen to become cost competitive. With proper engagement of businesses already in this space, the UK government may well be able to deliver on the promises it has set out.

Look out for the next Regen hydrogen blog

In our next blog, Regen will be looking in more depth at the structure of the hydrogen value chain and considering how hydrogen markets can be developed and supported by national and regional policy makers.

[i] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/936567/10_POINT_PLAN_BOOKLET.pdf

[ii] https://www.sgn.co.uk/H100Fife

[iii] https://www.theccc.org.uk/wp-content/uploads/2018/11/Hydrogen-in-a-low-carbon-economy-CCC-2018.pdf

[iv] https://www.theccc.org.uk/publication/net-zero-technical-report/

[v] https://www.tno.nl/en/focus-areas/energy-transition/roadmaps/towards-co2-neutral-fuels-and-feedstock/hydrogen-for-a-sustainable-energy-supply/ten-things-you-need-to-know-about-hydrogen/#:~:text=Green%20hydrogen%20has%20a%20higher,fuel%20cell%20of%20a%20vehicle.&text=The%20production%20of%20blue%20hydrogen,and%20at%20relatively%20low%20cost

[vi] https://www.klgates.com/epubs/h2-handbook/index.html

[vii] https://www.woodmac.com/our-expertise/focus/transition/hydrogen-production-costs-to-2040-is-a-tipping-point-on-the-horizon/

[viii] https://www.carbonbrief.org/in-depth-hydrogen-required-to-meet-uk-net-zero-goal-says-national-grid

[x] https://www.surfnturf.org.uk/

[xi] https://www.itm-power.com/news/new-factory-update-and-senior-production-appointment

[xii] https://www.itm-power.com/date/2020/6?catid=5

[xiii] https://www.h21.green/about/

[xiv] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/910382/Business_models_for_low_carbon_hydrogen_production.pdf