Earlier this week, The Crown Estate announced alterations to the leasing process for Offshore Wind Leasing Round 5 – The Celtic Sea. With a focus on port development and social value, the announcement is a positive first step for the floating offshore wind in the region, but there is still more clarity needed.

In its highly-anticipated developer webinar, The Crown Estate has presented its plans for the upcoming Celtic Sea leasing round, having taken onboard industry feedback. This fifth leasing round provides a solid and positive foundation to deliver floating offshore wind (FLOW) projects for the first time in the Celtic Sea – both at pace and scale.

An increased focus on auction transparency, port development and social value has been welcomed by industry. These changes are a positive first step towards a more collaborative and strategic approach, which will demonstrate to the global market the long-term capacity and capability of the industry and the region.

That being said, there is still uncertainty regarding the Celtic Sea and, like most good things, the devil will be in the detail. It is notable that The Crown Estate did not publish a full timeline for the leasing round, although it was indicated that the “Information Memorandum“, which marks the opening of the leasing process, will be released before the end of the year.

Project Development Areas

Arguably the most notable announcement from Tuesday’s webinar was the progression from five ‘Refined Areas of Search’ identified in October 2022 to four minded-to ‘Project Development Areas’ (PDAs). As the easternmost areas of search, it is not overly surprising that the four minded-to PDAs are in zones A and B. With proximity to the shoreline and future grid connections, these “first phase Celtic Sea development sites” offer extremely attractive investment opportunities for the global market.

However, this decision means that developers will have to deliver their projects to much tighter spatial design parameters than may have been initially expected. This will require a highly coordinated approach; including the likely use of shared infrastructure and the phasing of projects to optimise the use of the regional supply chain. How this coordination will work in tandem with policies such as Ofgem’s Decision on Pathway 2030 for coordinated offshore transmission infrastructure, the anticipated Holistic Network Design (HND) and the role of future cost-competitive Contract for Difference auctions remains to be seen.

As managers of the seabed, The Crown Estate must ensure that existing seabed demands are not compromised and it was made clear that the Celtic Sea has a number of competing interests. The Crown Estate is still engaging extensively with governments, stakeholders and policy drivers to resolve any further spatial matters. The first phase of projects will support the establishment of a FLOW industry in the Celtic Sea, however, to ensure that focus remains on the Celtic Sea, industry will want certainty that spatial issues have been resolved and that there will be no barriers to a future pipeline of projects, delivering on the opportunity for another 20 GW.

To ensure that the supply chain, local communities and the whole energy system can benefit from the development of FLOW in the Celtic Sea, industry needs to see a clear signal of these opportunities and leasing round timelines beyond the 4 GW allocated for Round 5.

Pre-Qualification Questionnaire

The Pre-Qualification Questionnaire requirements remain high-level, yet the financial requirements appear tough. The adoption of a ‘rising clock’ auction, under which prices and demand are revealed after each auction round, gives greater transparency and better price discovery for developers. Yet to be able to get to auction, there is significant emphasis on offshore development experience and financial strength. It is clear that developer consortia must have access to a substantial balance sheet that is capable of funding development at scale.

Supply chain plans and integration ports

Another notable change from the October 2022 announcement was the removal of the requirement to submit a supply chain plan. There is still, however, a strong focus on assembly and integration ports and developers will be required to show evidence that they are working with ports and will have access to port capacity. Supporting these ports is critical for regional supply chain development and highlights the early commitments needed to ensure they are prepared for FLOW; particularly as it has been acknowledged that regional ports do not currently have the integration facilities required to support FLOW at the scale and pace required.

The industry and governments must now make sure that corresponding investment initiatives work in parallel with the timescales set out for the Celtic Sea. FLOWMIS was a good first step in identifying the importance of UK ports in delivering FLOW, but with tight timelines and a limited pot of cash (up to £160 million), further investment is needed to support UK ports to become the assembly and integration ports of choice.

Social value

New aspects of the tender design encourage developers to create lasting social and environmental value. With an emphasis on employment, skills, education, inclusion, environment and communities, developers must demonstrate the legacy that their projects will create to progress to the next round of the leasing process. Even prior to this announcement, many developers interested in the Celtic Sea have been engaging with schools, colleges and the supply chain, and so it is encouraging to see that The Crown Estate recognises the importance of this work in preserving the security of future jobs and the environment. However, the caveat lies in the capacity and resource of individual developers to invest time, effort and capital into ultimately implementing these wider plans.

A step in the right direction but more clarity needed

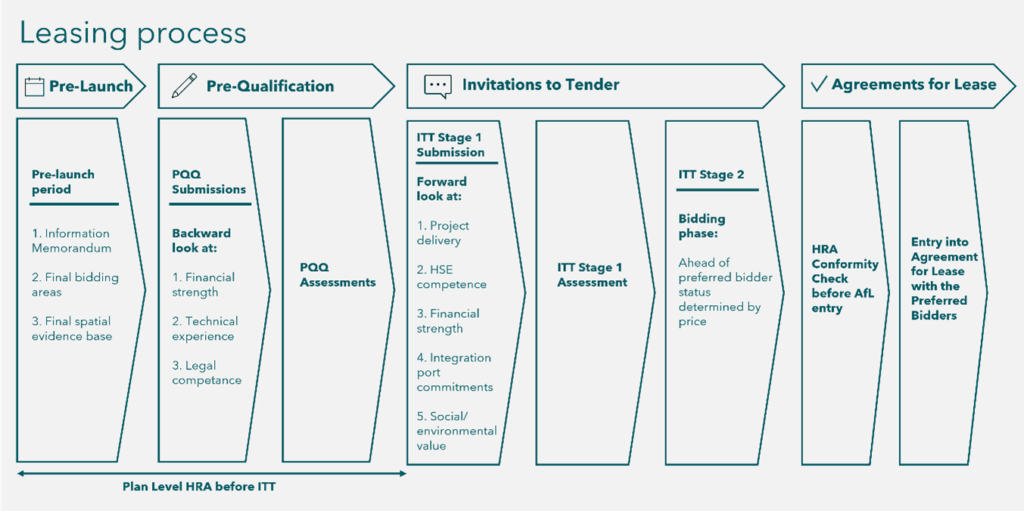

The Crown Estate highlighted the work it is doing to de-risk and accelerate the delivery of Leasing Round 5. Pre-consent surveys, upfront environmental assessments and the design for a plan-level Habitats Regulation Assessment were positive first steps, and the plan to integrate the leasing round with the HND for the offshore grid has been innovative in many ways.

However, the lack of a set timetable for this leasing round, coupled with uncertainty on how this will coincide with the HND, has left questions to be answered.

It is clear from these announcements that The Crown Estate is listening to industry feedback and is keen to work alongside the sector to kickstart FLOW in the Celtic Sea. The focus on port infrastructure and social value demonstrates the investment opportunities and benefits that are within reaching distance for the region. Now we must move forward, with greater clarity from The Crown Estate and National Grid ESO, to deliver the first FLOW projects in the Celtic Sea and to outline the future of the Celtic Sea to another 20 GW and beyond.

Interested in hearing more? Reach out to Becky Fowell here.