Heat remains one of the most challenging areas of the UK energy system to decarbonise. A number of pathways are being explored, including deeper levels of energy efficiency, broad-scale electrification, low-carbon heat networks and the development of hydrogen as a new heating fuel.

Electrifying the provision of domestic heat through heat pumps, allied with heat storage technologies, could provide a near-term, low-carbon solution for heating our homes. The big question is whether it is viable to roll out heat pumps in large numbers, and more to the point, whether heat pumps will be able to replace gas boilers in a decarbonised future.

The National Grid Future Energy Scenarios 2019 sets out four scenarios for the future of the energy system. In the two scenarios that meet the UK’s previous 80% carbon reduction target by 2050, (which has since been changed to ‘net-zero’), the number of installed heat pumps in Great Britain is projected to rise from 150,000 in 2018 to between four and six million by 2035. However, the heat pump roll-out to date has been very slow, achieving an average of only 18,000 installations each year since the start of the Renewable Heat Incentive (RHI) in 2011. This limited growth has largely been due to a combination of:

- High upfront costs, (which can take several years to pay back under the RHI scheme)

- Perceived complexity of heat pumps compared to legacy systems

- Lack of public awareness of their benefits.

Regen’s analysis shows that, to date, domestic heat pumps have typically been installed either in new-build properties, social housing developments or properties that are not connected to the gas network. In these use cases, heat pumps have proved attractive because they are either replacing higher-cost heating solutions (oil, LPG and direct electricity) or are benefitting from reduced installation costs in new developments or multiple-occupancy buildings.

The financial feasibility of installing heat pumps more widely across all domestic building types, including those on the gas network, has proved more challenging:

- Retrofitting high energy cost, electrically-heated homes and flats looks attractive on paper, but when the heat demand is low and the additional cost of installing ‘wet’ heating pipework is factored in, the business case for installing a heat pump can be marginal.

- For on-gas properties, the main challenge is the cost of a heat pump installation and the electricity to run it, compared with the lower price of a gas boiler and the current low price of gas.

However, in a series of use cases modelled and discussed below, Regen has identified a number of cases where heat pumps could become cost-efficient, if supported by suitable energy policy, reasonable cost reductions and innovative installation practices.

Regen’s domestic energy asset model

As part of the Bristol Energy Smart Systems Transition (BESST) project, Regen has developed a model that measures the value of various energy assets (storage, solar PV, heat pumps and energy efficiency measures) in different domestic property types. The model assesses both the financial return and the carbon impact of installing assets in isolation, as well as the cumulative impact of applying multiple measures.

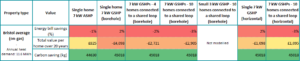

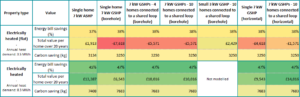

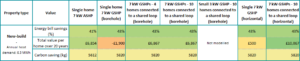

The tables below show the value created from the delivery of air source heat pumps (ASHPs) and ground source heat pumps (GSHPs) deployed either as individual units, or multiple units connected to a shared ground loop/heat network, in different types of domestic properties. The value is measured in terms of:

- Energy bill savings (%)

- Total value per home over 20 years (the net revenue from customer bill savings and RHI payments over a 20-year asset lifetime, minus the capital cost of the heat pump system)[1]

- Carbon emission savings per home over 20 years (kgCO2e)

Use case 1 – average gas-heated house

While the carbon savings are significant in this use case, there is limited financial value in fitting a gas-heated home with a standard heat pump system at current costs. The main constraint here is the price of electricity compared to gas, which is currently distorted, as electricity costs include a higher level of decarbonisation and societal levies. At current commodity costs, there are no energy bill savings for on-gas houses meaning the total value generated is, therefore, the difference between the RHI income and the capital cost of installing a heat pump system.

Nevertheless, there are certain conditions that would improve the case for installing a heat pump in an ‘on-gas’ house. These include:

- Installing a heat pump at a time when the boiler needs replacing, to avoid the boiler replacement cost

- Using horizontal ground loops where the property has a suitable outside area available, to reduce groundwork costs

- Use of a shared water or ground loop that connects a series of heat pumps, lowering the installation cost per customer

- Connecting to a heat network that supplies waste heat at a cheaper rate (city-wide heat networks using heat pumps are currently under construction in Bristol)[2]

- Economies of scale where heat pumps are purchased in bulk (further sources of cost reduction are possible and are discussed below)

A combination of all of these actions could make the case for installing a heat pump very attractive, though not all homes will be suitable.

Use case 2 – electrically-heated homes (high and low demand)

The value of installing a heat pump in an electrically-heated home varies depending on the heat demand – greater demand means greater bill savings, more RHI income and more carbon emissions avoided. A building with a high annual heat demand of 8,300 kWh could generate a net value of £5,000–£15,000 over the lifetime of the asset, which makes it very attractive as an investment. However, there is a risk that future energy efficiency measures would not be deployed in these homes in order to maintain the levels of RHI payment.

For small, electrically-heated flats with a low heat demand, a small 3 kW GSHP connected to a shared ground loop can be used, which is cheaper to install and maintain . Although the total value is lower than the high-demand case above, potential cost reductions (discussed below) would make this option financially viable.

Use case 3 – new-builds

At present, the case for heat pump systems in individual new-build properties is limited by the fact that they do not qualify for the domestic RHI (with the exception of self-build units)[3]. But where they qualify for the non-domestic RHI (e.g. in shared ground loop systems), high returns are possible, largely due to the lower groundwork costs for new developments.

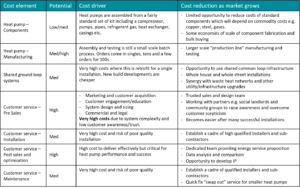

Potential cost reductions

The biggest barrier to large-scale heat pump deployment is cost. The table below shows that many of the costs associated with heat pumps are characteristic of an evolving market that is still in its infancy; there is scope for manufacturing, installation and maintenance processes to be optimised and therefore less costly in future.

Many of the cost-reduction opportunities could also be delivered by an Energy Service company, offering a supply, installation and service package over the lifetime of the asset. In order to minimise costs, the Energy Service company would need to:

- Market to and recruit customers (working with social landlords, housing developers, community groups etc.)

- Design and size systems to cater for different properties

- Manage installations (performed in-house or by accredited third-party contractors)

- Perform post-install monitoring, fault checking and optimisation

- Provide performance warranty and assurance

- Manage regular maintenance (performed in-house or by accredited third-party contractors)

- Handle repairs and replacements

Summary

It is encouraging that there is a strong financial incentive for installing heat pumps in many off-gas and new-build properties. However, the low price of gas makes the case for heat pump installation in on-gas properties very difficult in the current market. Around 87%[4] of UK homes are connected to the gas grid, which presents a major challenge if we are to decarbonise domestic heat. If heat pumps are to play a key role, the cost reductions discussed above would need to be realised, in addition to continued support through the RHI, or an equivalent scheme, post-2021.

Another broad-scale option for decarbonising on-gas homes is the use of hydrogen instead of natural gas. The development of hydrogen infrastructure is a significant investment with many technical challenges and therefore, to meet short-term and long-term decarbonisation targets, a combination of low-carbon solutions is required. Domestic heat pumps are a sensible, low-regret measure in off-gas homes and new-builds, and could potentially play a role in on-gas homes as well (particularly when installed as part of a shared ground loop), if equipped with strong energy policy and further cost reduction.

[1] This figure represents the total value gain and would be split between asset maintenance costs, supplier or service company margin and customer bill savings

[2] Bristol’s Heat Network: https://www.energyservicebristol.co.uk/business/heat-networks/

[3] Ofgem RHI guide for new-builds: https://www.ofgem.gov.uk/sites/default/files/docs/2014/10/drhi_helpsheet_custombuild_v1_1_feb_2015_web.pdf

[4] Sub-national estimates of households not connected to the gas network: https://www.gov.uk/government/statistics/sub-national-estimates-of-households-not-connected-to-the-gas-network

Regen’s analyst,

Regen’s analyst,