Our policy and advocacy manager Madeleine, collects some thoughts on the future role of the electricity system operator, ahead of possible major announcements

Our policy and advocacy manager Madeleine, collects some thoughts on the future role of the electricity system operator, ahead of possible major announcements

“The government will review the right long-term role and organisational structure for the Electricity System Operator, in light of the reforms to the System Operator instituted in April 2019”

National Infrastructure Strategy, November 2020

The process of separation of the management of infrastructure and the operation of the electricity system started some five years ago, completing in 2019. National Grid Electricity Transmission (NGET) (the transmission owner) and National Grid Electricity System Operator (NGESO) are now two legally separate companies, complete with Chinese wall at their offices in Warwick.

But the debate about separation hasn’t ended there. The rapid transformation of the energy system triggered by the net zero target and rapid technological change is leading to debates about whether the NGESO may need to be split further from its transmission owner counterpart, potentially even taking the ESO under public ownership. Perhaps most notably, Dieter Helm argued for this in his 2017 tome, the Cost of Energy Review.

There have been rumours that the Energy White Paper will lead to further structural change for the ESO and a formal review has now been confirmed by government in the National Infrastructure Strategy.

In 2019, Regen wrote a paper, Energy Networks for the Future, discussing what large-scale structural change might mean for system and network operation. In this blog, we’ll revisit some of the findings of that paper and how ESO ownership might affect those conclusions.

Further separation: why is it necessary?

There are a lot of arguments and debates about why the NGESO may need to be split further from its transmission owner counterpart – here are a few issues at play.

The reason for the separation of the transmission owner and the system operator was to allow the ESO to run the system without market bias towards the infrastructure arm of the organisation. As decarbonisation demands a more flexible system, separating the two functions allows the ESO to provide a neutral market base for either flexibility solutions or infrastructure upgrades. However, given that NGET is still a sister company to NGESO, some doubt the ability for the companies to be truly separate, and for a market created by NGESO to be truly neutral.

Perhaps more appropriately known to some as the Bermuda Triangle of energy policy – the Department for Business, Energy and Industrial Strategy (BEIS), Ofgem and NGESO are the core decision-makers for the future of the energy system. Separating the ESO more explicitly from private ownership could give it more ability to work closely with BEIS and Ofgem to direct energy policy and be a driver of change. Indeed, we’ve recently seen some incredible policy leadership from NGESO – could putting the organisation on a more equal footing with BEIS and Ofgem give that policy direction more weight?

The first price control process for NGESO as a separate entity has been a tricky process. By using a price control mechanism created for infrastructure companies, incentivising investment for a services company has been fraught with difficulties. NGESO complain that their returns are based on risk against their assets – of which they have few, now they are split from NGET. A different framework for investment may be necessary, but the regulated monopoly of the energy system has never been easy to manage and the ESO may benefit from a different model of ownership as a result.

Energy networks for the future

Strategic direction and leadership

In 2019, we wrote a paper sketching out a new model for network governance. Written amid the nationalisation debates ahead of the 2019 election, we concluded that broad structural change of the networks was needed, regardless of the ownership model. Here we revisit that paper a year on, with the possibility of ESO separation in mind.

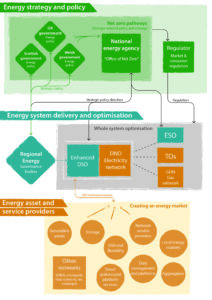

A key output of the paper is the sketch of a future network governance model (see image). Much of the restructure recognises the need for clearer direction and leadership at every level, with policy decisions embedded in the system, not taking place outside of it.

In the first instance, this direction must come from the top – many have identified the ‘execution gap’ between the UK’s ambitious targets and the policy needed to deliver them. A new body with dedicated focus on developing a long-term energy strategy could fill that gap.

At the local level, energy governance must have a clearer link between the local authorities and the network operators, with local bodies given a more formal role and devolved powers over the future of critical infrastructure.

A net zero mandate must be embedded throughout the system; most importantly with Ofgem, who still do not have a decarbonisation as a statutory priority.

A structure like the one sketched out here would give a stronger remit and clearer direction across the system, allowing decisions on planning, investment and social issues to be made jointly, with network operators working closely with each other, with policy makers, and with local authorities to achieve a clear goal.

Investment, incentives and managing risk

In a regulated monopoly, creating the right incentives, allowing appropriate revenues, and encouraging the right investment for network operators is a very difficult task. The RIIO1 process, while an improvement on previous models, is still in need of improvement and as mentioned above, is currently facing criticism from NGESO. Ultimately, the price control process needs to better encourage and enable networks to make strategic investments and manage risks.

Our paper explores the RIIO model and we identify some key issues with the process:

- The RIIO model is essentially a centralised process and although there are prerequisites for stakeholder engagement, there is a lack of more formal regional and stakeholder governance, approval and accountability.

- Networks should be empowered to work with regional stakeholders to make strategic investments that can help regions create their own decarbonisation pathway, optimise investment costs, minimise risk and respond to local and regional social and economic priorities.

- The way RIIO handles uncertainty and risk encourages an overly cautious planning approach, both by the regulator and the networks.

- The Totex Incentive Mechanism2, which incentivises networks to optimise network asset investment, does not easily differentiate between cost efficiencies, including the use of smarter non-network solutions, and simple investment deferral

The table below shows a new approach to investment and risk, allowing a separation of investment types to better manage those classes with higher risk and great uncertainty.

There is an inherent risk and uncertainty that accompanies periods of industry transformation, partly exacerbated by the lack of clear policy direction mentioned above. The price control approach needs to be improved to accept and manage these risks, but in the case of the ESO, it may be that as it is such a vital, driving force behind energy sector operation and decarbonisation, a different approach may be needed altogether to get to the desired outcome.

Ensuring a just transition

A just transition that delivers positive social outcomes is essential to maintain public and political support. This includes the protection of vulnerable customers and ensuring a just and equitable transition that enables consumers and workers to fully benefit from the transition to a future net zero carbon energy system.

Networks can play a significant role to ensure the equitable treatment of consumers and access to new technology and markets, for example by:

- Ensuring networks play their role as part of a wider low carbon industrial strategy to enable the transition of skills and workforce to the new economy.

- Continuing to focus on support for vulnerable customers, but also the distributional impacts of network charging on energy poverty.

- Ensuring that access to new energy services, such as domestic EV charging and flexibility markets, is equitable and that no customer is left behind.

- Encouraging networks to collaborate with devolved, regional and city bodies, potentially through co-investment models, to provide economic and social stimulus in deprived areas.

As a private company, the ability to achieve such goals is always limited and requires close work with the government, local authorities and social organisations. By separating the ESO from private ownership, it could aid closer links to central and local policy making, helping the ESO to provide the above social outcomes.

What next for the system operator?

System operation is an integral driver of decarbonisation, but not easy to regulate and manage. National Grid ESO has been a strong force moving the sector forward and setting high ambition; their commitment to run a net zero carbon grid by 2025 was welcomed by the sector. However, as we ramp up decarbonisation and move to a grid that looks vastly different to the traditional model, perhaps a new structure will be necessary which can enable the investment and leadership required.

[1] RIIO “Revenue = Incentives+Innovation+Outputs” periodic investment, price and revenue review process For a more complete explanation of the RIIO model see https://www.ofgem.gov.uk/system/files/docs/2017/01/guide_to_riioed1.pdf

[2]The RIIO total expenditure (Totex) approach seeks to create a level playing field between Opex or Capex. The Totex Incentive Mechanism efficiency incentive rate sets the percentage value share of any under- or overspend.