Ofgem’s RIIO-3 sector-specific consultation raises important questions around how we prepare for the eventual decommissioning of the gas network and how we pay for the network through the transition.

In the week before Christmas Ofgem released its sector-specific consultation [1] on how to manage the regulatory price controls for the gas transmission and distribution sectors during the RIIO-3 period. Buried in the Finance Annex lies some eye-opening analysis which raises important questions about how we transition fairly from gas to electricity. Although not a complete strategy, this annex shows that the regulator has begun to think about this difficult issue.

The key problem Ofgem has identified is how to pay for the £26.1 billion Regulated Asset Value (RAV) – the amount of outstanding capital value in network assets which has not been paid for by consumers – as households and industrial consumers disconnect from the gas networks. Without changes to the current approach consumers will face spiralling network charges and, despite increasing, not all costs will be covered by 2050.

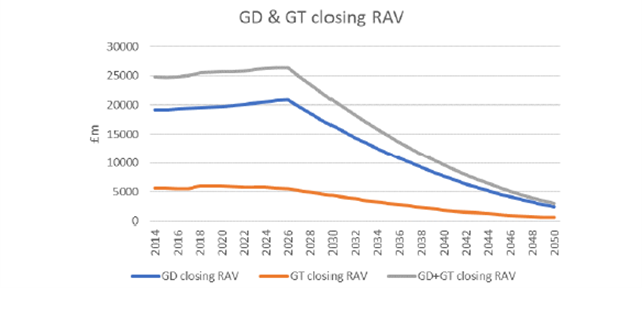

Under the current regulatory model, network owners make investments in the energy networks which are then paid for by customer network charges to cover depreciation and a return on investment over the lifetimes of the assets. This approach, with depreciation over 45 years, will leave about £3bn of residual RAV in 2050 based on existing assets (see Figure 1). Any new investment during the ED3 period and beyond will increase the outstanding asset value and future network costs.

Ofgem points out that net zero in 2050 is incompatible with fossil gas assets having economic value beyond 2050 so it is considering reducing asset lives or ‘front-loading’ depreciation to accelerate the return on capital to asset owners.

Figure 1: Gas Distribution and Transmission Regulated Asset Value (RAV) balances

Source: RIIO-3 Sector Specific Methodology Consultation – Finance Annex, Section 8, Figure 3.

The energy transition will have two major implications for gas networks:

- A fall in customer base as household and commercial customers switch from gas to electricity

- A reduction in gas consumption from consumers that remain. For example, gas power generation will switch from base load to peaking and eventually to back-up supply.

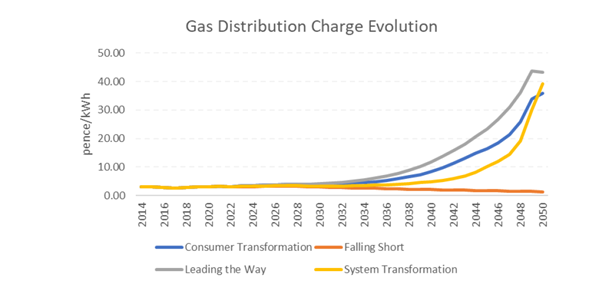

The impact of a falling customer base and lower gas consumption could see the energy unit cost of gas network charges rising rapidly from 2030 onwards.

Gas distribution charges per unit of energy are set to skyrocket as gas demand falls

Figure 2: Gas distribution network consumer bill estimate under different FES scenarios

Source: RIIO-3 Sector Specific Methodology Consultation – Finance Annex, Section 8, Figure 4.

Ofgem has estimated that network charges could reach 10p/kWh by 2040 and 40p/kWh by 2050. Network charges could accelerate earlier and end up higher if they include:

- An accelerated depreciation of the RAV – which Ofgem considers an option to ensure that current consumers pay their fair share

- Any new natural gas network asset investment from RIIO-3 onwards

- Decommissioning costs, which, according to a recent study by Arup for the NIC and Ofgem, could be significant and which Ofgem is considering pre-funding as early as RIIO-3.

Increasing network charges would likely create a feedback loop as households and businesses will be incentivised to switch away from gas, raising network charges further. While many will see this as a positive and necessary step to drive the transition to net zero, the ramifications for those customers still using gas could be enormous.

Higher charges will raise the issue of fairness. Those consumers still using gas for heating in the late 2030s and into the 2040s may well be doing so because it is difficult for them to switch (such as those with lower incomes and the fuel poor, or people who cannot make the decision unilaterally like renters or people living in shared buildings of flats). Is it fair that those people pay for the remaining RAV balance while everyone else dashes to the exit? Ofgem is right to highlight the issue of fairness here.

In one area of good news for gas customers, Ofgem has clarified that hydrogen infrastructure development is out of scope for RIIO-3 and will be funded via the Hydrogen Transport Business Model (HTBM). Regen supports this, given that current users of natural gas (domestic, commercial and industrial) do not equate to future users of hydrogen (almost exclusively industrial) and will avoid consumers paying towards a fuel they don’t end up using.

Options for Ofgem

Ofgem outlined five sources to plug the £3bn forecasted RAV gap [2]:

- Government – though the document later mentions that Ofgem “must plan to recoup the costs from current and future consumers”

- Gas network investors – which Ofgem highlights would “create asset stranding risk” and “likely not in the consumer interest”

- Future consumers – though Ofgem highlights this will be a small group of consumers with many falling into vulnerable categories

- Current consumers – requiring an increase in network charges from 2026

- Purchasers of the networks for repurposing – however, most of the remaining RAV is in the Gas Distribution Networks (which are less attractive for repurposing) and the network owners would probably claim any residual asset value to be theirs regardless of the RAV position

None of these options are likely to be appealing to the Government or Ofgem.

So what can we take away from all of this?

- It is positive that Ofgem is considering the long-term financial sustainability of the gas networks in the face of falling customer numbers and future demand for fossil gas, though this is probably still under the radar of many stakeholders.

- Ofgem has clearly set out that current gas network charges are unsustainably low and we must prepare for an increase. Raising charges is never popular but leaving them low and allowing current consumers to effectively borrow from a diminishing number of future consumers who are constrained to gas would be irresponsible, especially now the issue has been clearly identified.

- A laissez faire approach, with an uncoordinated decline in the gas network will be both unfair for those still connected and is likely to leave significant residual Regulated Asset Value.

- Whilst this might seem like a wholly technocratic issue, we have seen this year that issues like these can quickly be politicised. Providing early certainty to the trajectory of gas network charges may help to avoid a shock increase in the future.

- Whatever the short-term approach there is a significant risk that government and future consumers will end up footing the bill and effectively subsidising the fossil-fuelled heating of current consumers.

Endnotes

[1] RIIO-3 Sector Specific Methodology for the Gas Distribution, Gas Transmission and Electricity Transmission Sectors

[2] RIIO-3 Sector Specific Methodology Consultation – Finance Annex C

The transition to net zero energy is going to have impacts on households across the UK, changing how we heat our homes and get about, the make-up of our bills and the jobs many of us do. Ensuring the transition is seen by households as fair and reasonable, that the benefits are enjoyed widely and the costs don’t fall disproportionately, is arguably biggest challenge we face – and a key focus for Regen. Find out more about Regen’s Just Transition work.