In response to the ongoing wholesale market reform discussion, Regen’s latest insight paper explores the many locational signals that exist in the GB electricity markets and how they could be strengthened to support the decarbonisation of the electricity system. Co-author Ellie Brundrett, markets lead, examines the key takeaways.

The current market reform discussion has put locational factors at its heart, with the Review of Electricity Market Arrangements (REMA) consultation highlighting the need to provide efficient locational signals to minimise system cost as one of its four main challenges.

There are many ways in which locational signals could be improved from within the existing market arrangements, and a holistic review of how the signals that already exist in the system could be enhanced is an essential discussion of the current market reform process – one which has not yet been fully explored. Instead, the focus within market reform discussions to date has been on creating new locational signals within the wholesale markets, delivered via a locational marginal price (LMP), based on either nodal or zonal pricing locations.

What are locational signals?

Locational signals can be split into two types, depending on how they influence decision-making:

- Siting or investment locational signals encourage investors in new generation or storage assets, demand or sources of flexibility to favour one location over another. To be effective these must be long-term and dependable.

- Operational locational signals, alongside temporal signals, influence short-term decision-making, encouraging network users (generation, demand or storage/flexibility providers) to flex the demand or supply of electricity at a certain time and location. Operational signals could be forward signals such as day-ahead, or they could be real-time signals within the dispatch function.

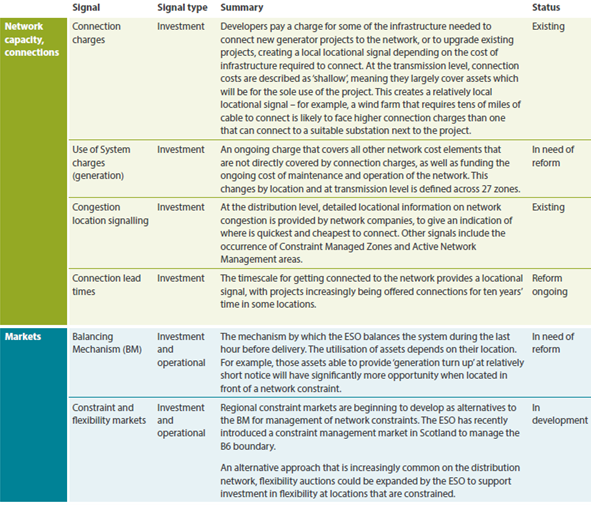

These signals can originate from several sources, but generally they can be grouped into four themes:

- Locational signals related to network capacity and connections

- Locational signals related to markets

- Locational signals related to spatial planning, land-use and energy resource

- Other policy mechanisms that could deliver a stronger locational signal

Table 1: Summary of the most significant locational signals at a national level including existing signals and those being explored by REMA

Given that within the current electricity system there already exists such a range of locational signals, originating from a variety of sources, why has so much of the market reform discussion to date centred around a move to a locational marginal price-based system?

Locational Marginal Pricing (LMP)

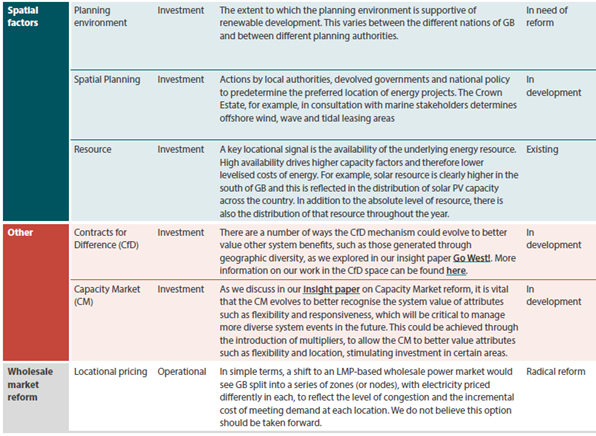

In simple terms, a shift to an LMP-based wholesale power market would see GB split into a series of zones or nodes, as illustrated in Figure 1, with electricity priced differently in each, to reflect the level of congestion and the incremental cost of meeting demand at each location. This would be coupled with a shift to a centralised dispatch process, where centrally managed optimisation tools are used to determine ‘cost optimal’ dispatch of generator outputs and settings of flexible demand and storage, based on bids and offers submitted by market participants to the system operator.

This represents a significant shift from the current system which is more decentralised, with electricity producers striking deals through bilateral forward contracts, Power Purchase Agreements, or trading on independent power exchanges, before notifying the system operator of their intention to generate.

Figure 1: Illustrative examples of (a) a zonal and (b) a nodal GB wholesale market. Source: National Grid ESO

LMP has been cited as a means to provide better locational signals to participants in the GB wholesale electricity market, with supporters suggesting that it would be capable of influencing both investment decision-making (including asset siting) and operational dispatch. However, in common with many of our industry colleagues, Regen is doubtful about the claims made that LMP would improve locational signals for future investment.

The danger of attributing the location of assets solely to the action of the market – and overlooking the myriad of other locational signals that influence decision-making – is explored in our paper Wild Texas Wind, which looked at the operation of LMP markets in the US. In that paper, we came to the conclusion that the success of Texas at delivering new investment in onshore wind capacity in the last decade had far more to do with strategic planning, investment support and a commitment by the System Operator and state authorities to build network infrastructure to connect west Texas, and very little to do with prices that vary between location. In Texas, once the initial network capacity had been exhausted and constraints rose, wind farm investors did not move themselves to areas of demand and higher prices (although they may have liked to) – instead, they stopped investing.

As we discuss in our latest insight paper, our opinion is that the benefits that some ascribe to LMP could also be achieved by strengthening the locational signals already present in the GB electricity system. This would still require reform of today’s model, but could be delivered more quickly, within the existing market arrangements – and with less risk of an investment hiatus than a shift to LMP may present.

Regen’s recommendations for strengthening existing locational signals via incremental reform:

For Ofgem:

- Reform network charging (TNUoS) to provide a long term investment signal for generation that is cost reflective, transparent, stable and consistent. A review of the signals directed at demand should be undertaken in tandem, ensuring that fairness is considered as a key criteria.

- Continue to reform network connection and queue management processes so that there is a consistent and integrated process between locations and across network voltages. At the same time, continue the shift towards more strategic and anticipatory network and system planning and investment, to direct the market to invest where assets are needed.

For the Electricity System Operator (ESO):

- Improve and enhance the operation of the Balancing Mechanism (BM), through digitalisation, IT investment, forecasting and market development, so that it becomes far more adept, efficient and competitive. The objective should be to reduce balancing and constraint management costs by making best use of low carbon generation and flexibility.

- Alongside the BM, work with Ofgem and the Distribution Network Operators (DNOs) to continue to develop operability, flexibility and local constraint management markets/services that will enable the utilisation of a wider range of assets and resources and to pre-emptively manage constraints. This would allow markets to send a stronger locational signal for flex providers and investors.

For the government:

- Harmonise planning policies to ensure alignment with the UK’s net zero targets. Empower local authorities, city regions and devolved governments (e.g. through Local Area Energy Plans, Regional System Plans and other local strategic energy system planning) to have more decision-making agency to send stronger local and regional signals as to where infrastructure, low carbon technologies and system assets are required.

- Retain the existing integrated GB wholesale market and seek ways to provide effective locational siting and operational signals via solutions and enhancements within the existing market structure, avoiding the risks associated with shifting to a radically new market design.

View the full paper here.

For more information about Regen’s work exploring energy markets for net zero, please contact Ellie Brundrett (ebrundrett@regen.co.uk)