Regen director, Johnny Gowdy, discusses the role of REGOs in our future.

Regen director, Johnny Gowdy, discusses the role of REGOs in our future.

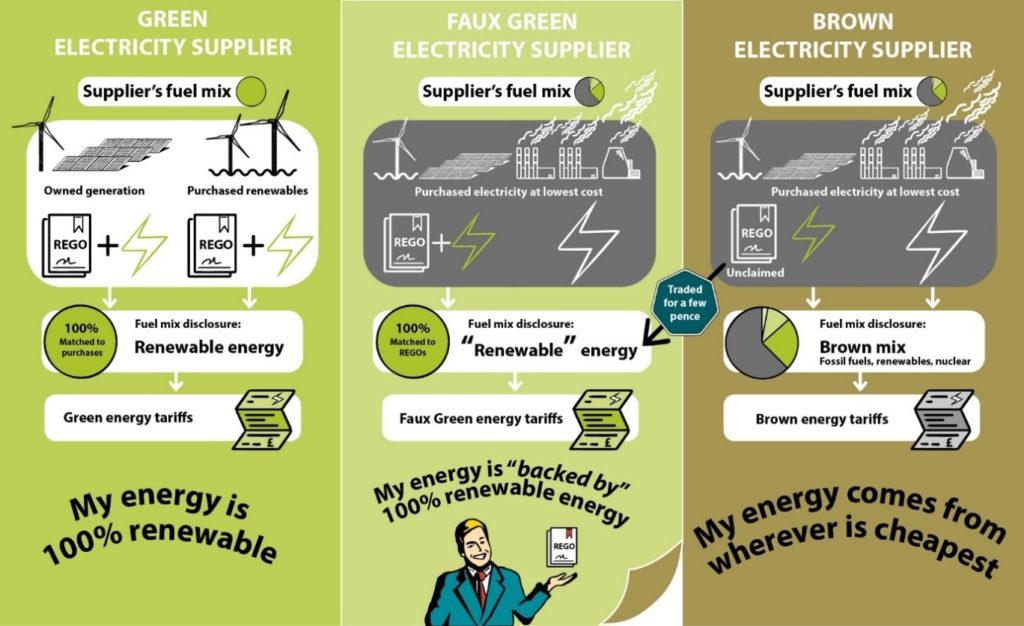

Keith Anderson, CEO of Scottish Power, recently blasted traders of Renewable Energy Guarantee of Origin certificates (REGOs), suggesting that they are “playing games with bits of paper”. This puts the spotlight on whether the system is working to reflect the value that energy users put on renewable power and encourage further investment in renewable energy. Regen has raised similar concerns regarding paper REGO trades being used for the purpose of greenwashing so called ‘100% renewable energy’ tariffs.

It is worth going back however to the original idea behind REGOs (and the wider international system of guarantee of origin certificates). The ability to trade the attribute of the greenness of energy was intended to provide an additional source of value, and market incentive, for renewable energy generators. Of course, when the scheme was devised the amount of renewable energy available was tiny, compared to the nascent demand for greenness, and so it was envisaged that certificates of origin would have significant worth.

In countries with growing levels of renewable generation has been a story of REGO supply far out stripping demand, leading to REGOs trading for a few pence per MWh. This has in turn enabled a boom in ‘green’ energy tariffs that cost energy suppliers and off-setters very little, without having a material impact to encourage investment in new projects.

So, do REGOs really matter? In the days of high subsidies and Contracts for difference (CfDs) the value of the REGO was less important. However, as we look forward to post-subsidy developments, or subsidies set at or below wholesale prices, a mechanism to reflect consumer and corporate demand for green energy could now play a key role in the business case for new renewable energy projects. For the REGO market to support decarbonisation as intended however there needs to be a significant increase in demand compared to supply, or changes to the way in which REGOs are traded.

A starting point, both for the industry and for policy makers, is to understand what the trading value of REGOs actually is. So, the launch of Renewable Exchange’s Rego Tracker is a very welcome development to shine the light of transparency on REGO prices for generators and traders alike.

Renewable Exchange’s figures show that prices for the REGOs they have traded as part of Power Purchase Agreements (PPAs) have been trending upwards in recent months and are significantly higher than the anecdotal price points we were previously aware of. A positive trend perhaps reflecting the number of corporates purchasing ‘green’ power and the continued growth of ‘green’ supply tariffs. However, at around £0.5 per MWh the value of a REGO is a useful fillip for existing generators but remains below the level where it would play a significant role in the way investors look at new renewable energy projects. Renewable Exchange’s data also shows the wide variance of REGO bid prices made, and that there are still a number of PPA trades for which the effective REGO price is zero. So, the REGO market is still finding its value.

With more corporates committing to ‘zero emissions’, and consumer demand for green energy, there are clearly demand side factors that could lead to the upward trend of REGOs value continuing. There is also the opportunity to up-sell REGOs from local community energy and iconic technologies for their corporate and social responsibility value. Across the broader market however, with major offshore wind projects, and potentially solar and onshore wind, coming online over the coming years, there will also be an increase in REGO supply.

The key factor that could disrupt the market is Ofgem’s commitment in its new decarbonisation action plan to review the marketing of green tariffs to protect customers. The decarbonisation action plan was launched on by Ofgem’s new CEO, Jonathan Brearley, on his first day in the role, and it looks like this is an area that will be vigorously pursued.

In the longer term a rise in the value of REGOs could be engineered in a number of ways including by setting a minimum REGO obligation, via the introduction of higher carbon prices, or the reconfiguration of existing environmental levies into a form of carbon levy. One possibility floated by market participants is that not all REGO’s should be born equal – projects built without subsidy could, for example, get a ‘super green’ REGO that would carry additional value by, for example, further reducing the burden of environmental levies.

For now, market supply and demand dynamics continue to drive the value of REGOs, but it could be the regulator that disrupts this market in the months ahead.

_

Author:

Johnny Gowdy

Regen has previously published an infographic explainer on green energy tariffs and REGOs, click here to read more: