Building on a trial looking for flexibility services in the Midlands last year, Western Power Distribution (WPD) has now extended their call for flexibility to other areas around the UK, by issuing a call for Expressions of Interest (EOI) for 18 new flexibility zones within five constraint areas, for winter 2018 and summer 2019.

This, alongside other similar activities around the country, is a big step forward for DNOs, following through on strategic commitments to facilitate a new market for local flexibility services. This emerging market could present a new opportunity for generation asset owners, large energy users, energy storage operators, communities and aggregators alike, either as a new source of income for operating flexible assets or as the potential to unlock constrained network areas, for new projects to connect and operate.

As an alternative to traditional network reinforcement, local flexibility can potentially help to manage peak energy flows, support planned network downtime/maintenance or unplanned faults, in particular areas of the network.

Flexible Power

Being advertised through WPD’s ‘Flexible Power’ brand, this EOI not only sees WPD delivering on its regulatory requirements to enable a market for local flexibility, but also shows WPD transitioning to its new role as a Distribution System Operator (DSO).

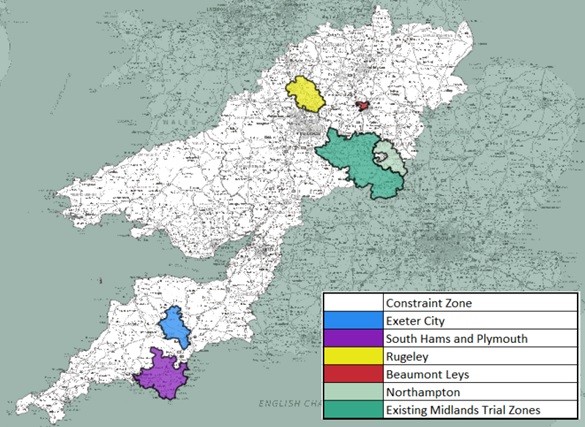

This business as usual EOI follows on from a consultation that WPD published in April, around ‘Signposting of distribution system needs’. This consultation intended to engage the industry around how best to collaborate with flexibility stakeholders, develop an accessible method of conveying and communicating the needs of the network and consult on some of the considerations of a contract between a flex provider and WPD. With this consultation closing in mid-May, it’s clear to see WPD has taken the feedback and set in motion a process to contract with flexibility service providers to help manage operational challenges, constraints and pinch points on their network. See Figure 1.

Figure 1: WPD 2018 EOI – Map of constraint areas (source: WPD)

Stringent entry requirements

By releasing this EOI, WPD has specified the conditions to participate and support the network, with flexibility providers needing to meet the following requirements:

- Must be within one of the identified zones

- Must be half hourly metered

- Must have minute by minute metering

- Must be able to meet the 15-minute dispatch signal and respond

- Must be able to sustain response for at least two hours

- Must be built or have a connection agreement with final milestone achieved before the end of the procurement period

- The provision of the flexibility service must not cause the participant to breach other agreements (e.g. connection agreement)

Different services meeting different network needs

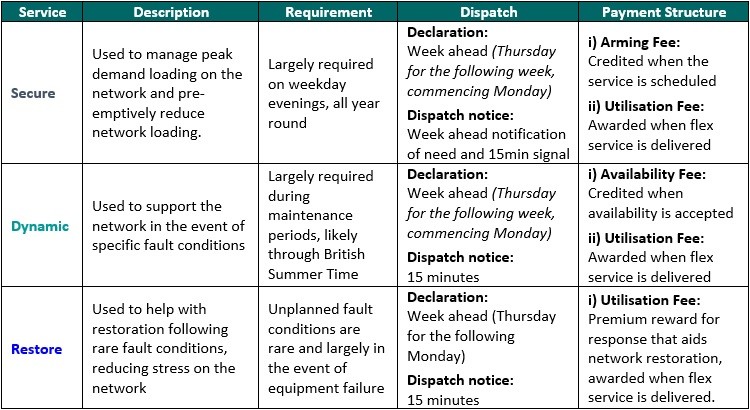

WPD has opted to procure three types of flexible service, each with its own function, set of requirements, timings of declaration/dispatch and payment structures. Regen has drawn out some of the key factors for these three services in Table 1.

Table 1: WPD Flexible Power services for businesses (source: WPD, Regen analysis)

New flexibility zones

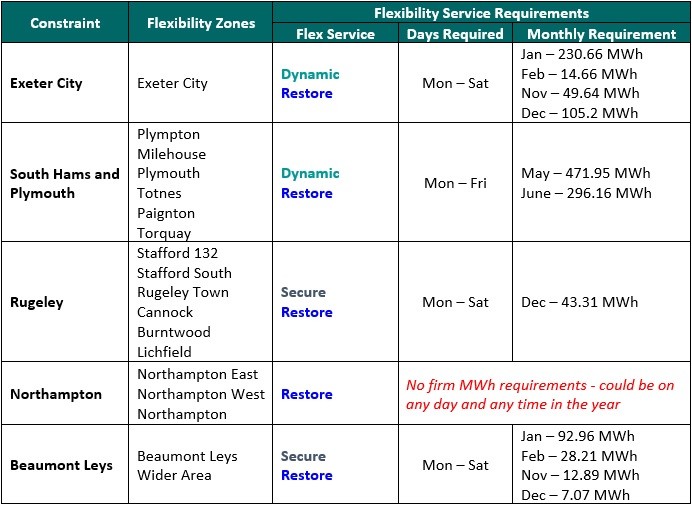

Within each of the five new constraint areas, there are multiple flexibility sub-zones (with the exception of Exeter) and WPD has provided indications as to the type of flexibility services required, the days they would be needed and an indication of monthly requirement (in MWh). We have summarised these requirements for each of the five new constraint areas in Table 2.

Table 2: WPD 2018 Flexibility EOI – Details of flexibility requirements, by constraint (source: WPD, Regen analysis)

The volume of energy required to meet WPD’s flexibility needs is not huge, with just over 1.3 GWh required in total across the five constraint areas for winter 2018 and summer 2019. This demonstrates the inherent value of flexibility as being more about when and where it is required and less about volumes of energy over a given season or year.

Potential providers of flexibility that have existing assets or proposed developments in the identified flexibility zones will be scrutinising these numbers, scoping out potential local competition and assessing whether their generation, demand or storage projects might be well placed to enter into a contract with WPD. Despite all DNOs echoing the commonly used mantra of being ‘technology or approach agnostic’, some providers may be able to extract value from these local flexibility market offers more directly, more easily or more lucratively than others.

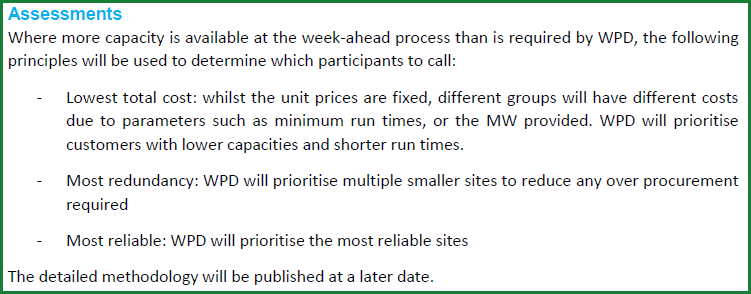

What is interesting to note is that not only has WPD opted to not include anything specific about minimum entry capacity (whereas UKPN and ENW have proposed 500 kW and 100 kW respectively in their EOIs, though with portfolio/aggregation permitted), but WPD has also indicated that in assessing week-ahead availability, ‘smaller may be potentially less risky’. See extract from the EOI:

From the perspective of spreading risk of non-response, smaller aggregated loads are seen as potentially lower risk for the DNO, compared to a single larger flexibility source. Smaller participants such as community and domestic providers may be subsequently optimistic, with their flexibility actions being seen as potentially more valuable or preferable to that of larger commercial and industrial actors.

Enabling households to actively participate in local flexibility, especially in the short timescales indicated in this EOI, is not straightforward however. Issues range from household demand requiring dispersed aggregation and a limited amount of truly flexible load in homes, to the verification of domestic response requiring a much higher coverage of smart meters. The potential to use smart appliances and aggregation technologies to bundle households together to bid into these markets is an exciting, if potentially complicated and challenging prospect. Regen is currently working in collaboration with Carbon Coop and Community Energy Scotland on a BEIS Flexibility Markets Feasibility Study Competition funded project, to look into the feasibility of a service, which aggregates flexible loads at the household/community level, to participate in local flexibility markets.

Size of the prize

For parties seeking to express interest, perhaps the most important information is the amount of money that is on offer to flexibility providers. This again is not a flat rate, with prices varying by:

- Type of flexibility service

- Type of payment (arming/availability fee and utilisation fee)

- Constraint area

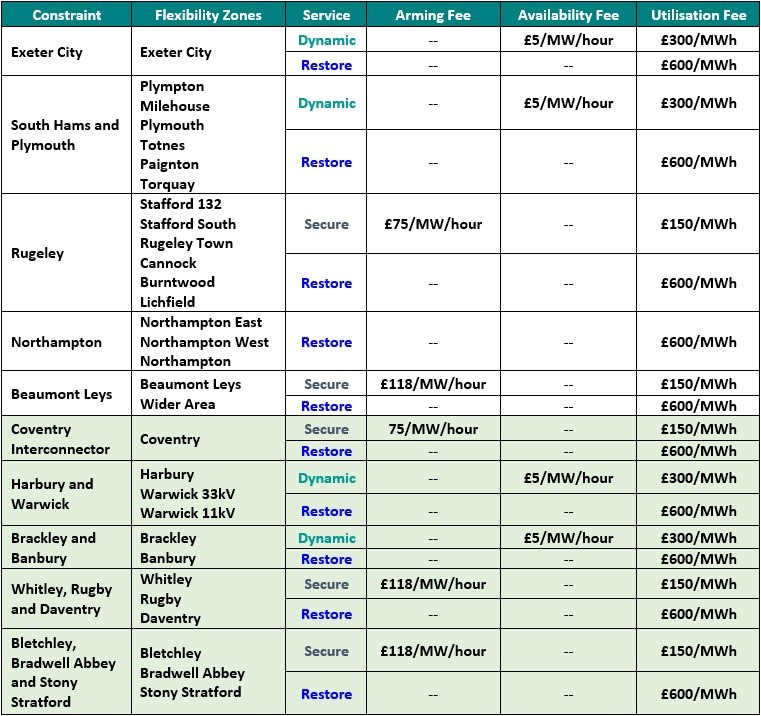

Reviewing the pricing information for both WPD’s Midlands trial and the new constraint areas published this week, the prices for each type of flexibility service is summarised in Table 3.

Table 3: WPD 2018 Flexibility EOI – price information (source: WPD, Regen analysis)

Flexibility services – open for business?

With other DNOs publishing similar EOIs and flexibility trading platforms from the likes of Piclo and Centrica opening up for registration, it is clear to see that the industry is moving away from innovation projects and trials, into the business as usual procurement of flexibility services.

Some key considerations around this emergent market can be drawn:

- Local flexibility is different from national balancing services, with local network operators turning to local operatives to address local network challenges. The matching of available assets to identified flexibility zones will create potentially competitive micro-markets

- The amount of income available is not the silver bullet for storage or other flexible assets. Project developers that might turn to local flexibility markets as an alternative source of revenue to fill the hole left by EFR/FFR saturation or Capacity Market de-rating, will need to continue to diversify their business models to simply add local flexibility income to their so-called revenue stack.

- Whilst there are similarities in methods and requirements, UK DNOs are taking different approaches on how they engage, procure and contract for flexibility. Ofgem’s requirements to see these markets facilitated nationwide will be on the radar of all the DNOs however, so we expect to not only see flexibility procurement activity increase significantly within the next two years, but the methods by which parties of all scales can participate to become more dynamic, accessible and open.

The level of response, the type and scale of technologies that respond to this EOI will be interesting to see. Regen will be hosting a series of ‘Flexibility Markets for Beginners’ events with WPD in the coming months and Ray will be speaking at the event in Cardiff on the 5th July (for more information click here).